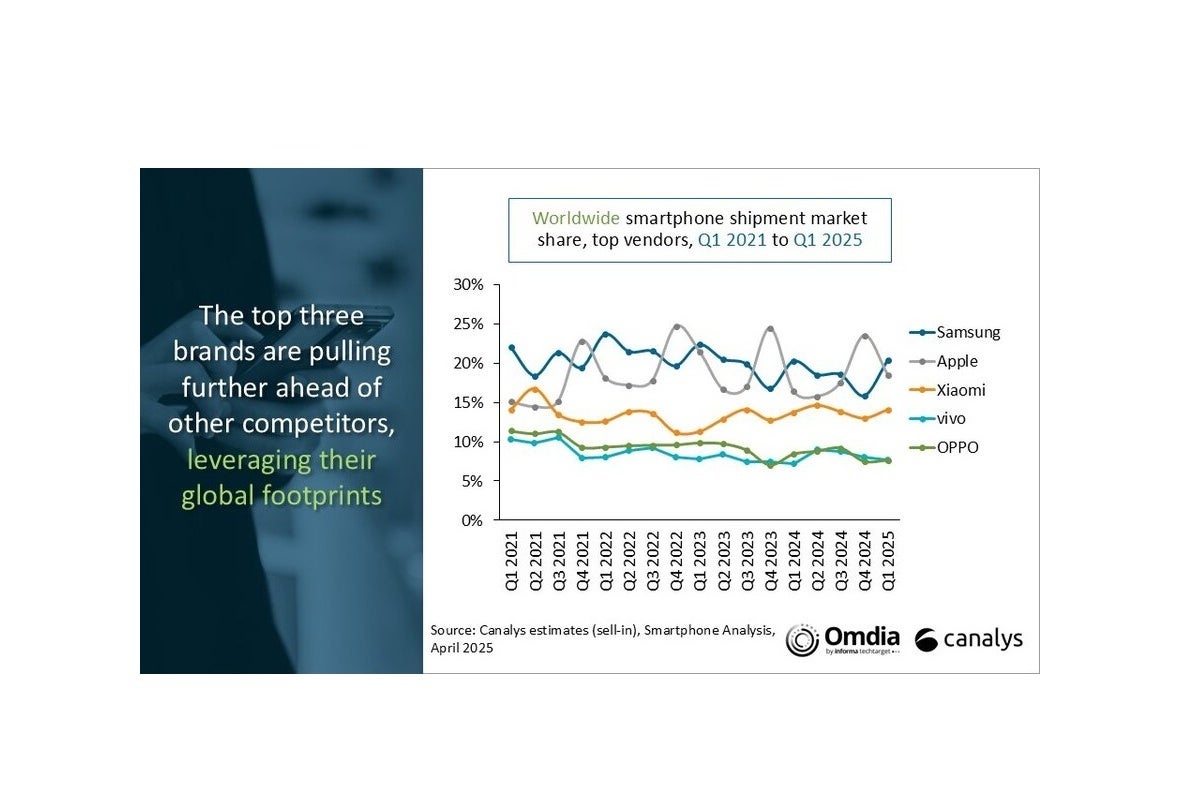

Samsung is number one after all, but Apple is growing like crazy

That’s definitely not a big gap between Samsung and Apple, and the order between the two could clearly be reversed soon.

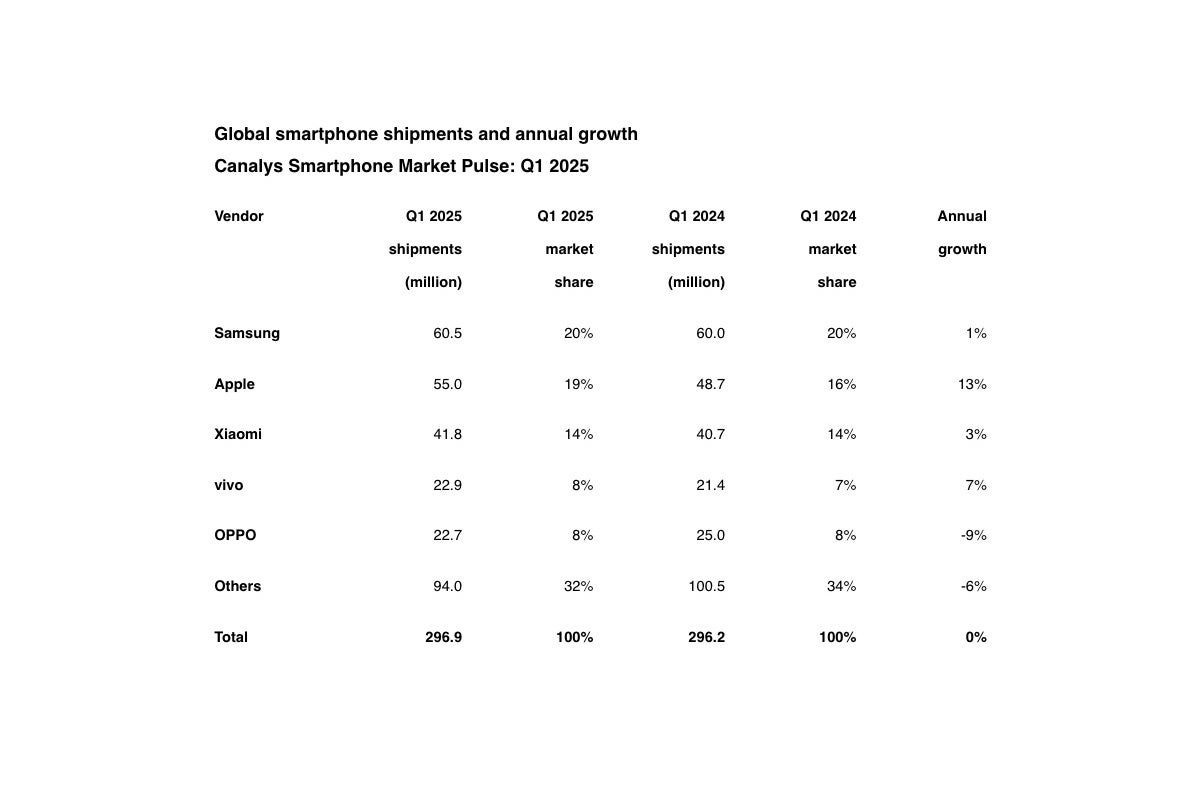

Samsung is again ranked first today as far as smartphone shipments from manufacturers to retailers (but not necessarily customers as well) are concerned, holding off a Cupertino-based arch-rival that remarkably managed to jump from 48.7 million units between January and March of last year to 55 million in Q1 2025.

That’s a 13 percent year-on-year growth for global iPhone shipments, pushing Apple from an already solid 16 percent market share to an even juicier 19 percent slice of the pie. In first place, Samsung sits at the exact same 20 percent market share as a year ago after barely boosting its shipments from 60 million to 60.5 million units.

Only one of the top five vendors saw its shipments decline in Q1 2025, but Samsung’s growth was… microscopic.

In third and fourth place respectively, Xiaomi and Vivo managed to increase their Q1 shipment figures more handsomely than Samsung but nowhere near as impressively as Apple, while Oppo slipped from its fourth position last year to the number five spot due to a worrying decrease in demand of 9 percent.

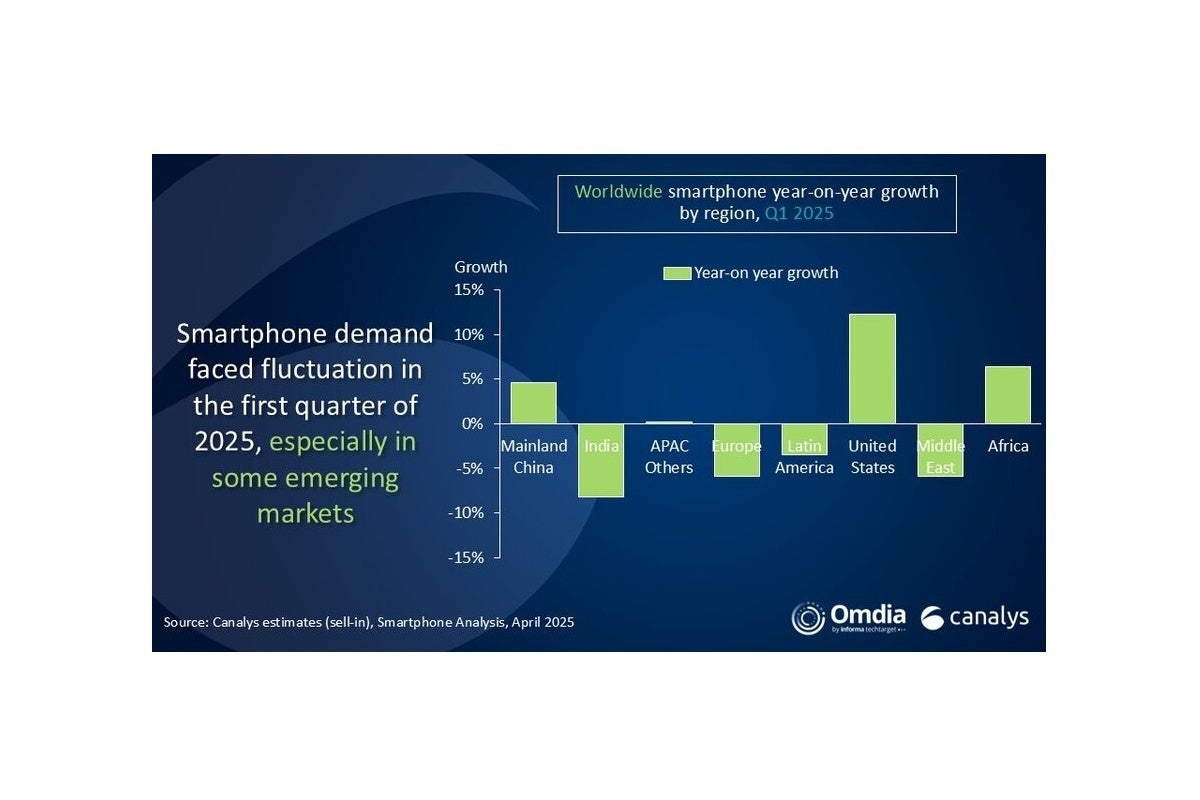

The US and China are up, India and Europe are down

Unlike the previous Canalys analysis, this new one tackles the evolution of regional numbers in addition to the progresses and decline of the world’s top five smartphone vendors. Surprisingly or not, the US is the major region that saw the largest growth in the January-March 2025 timeframe, followed by Africa and Mainland China.

It’s not every quarter that the US market expands and the Indian market shrinks like this.

Meanwhile, the overall shipment scores in India, the Middle East, Europe, and Latin America all went down from the first three months of 2024, so it shouldn’t come as a big surprise that the market in its entirety was essentially flat based on this final Q1 analysis.

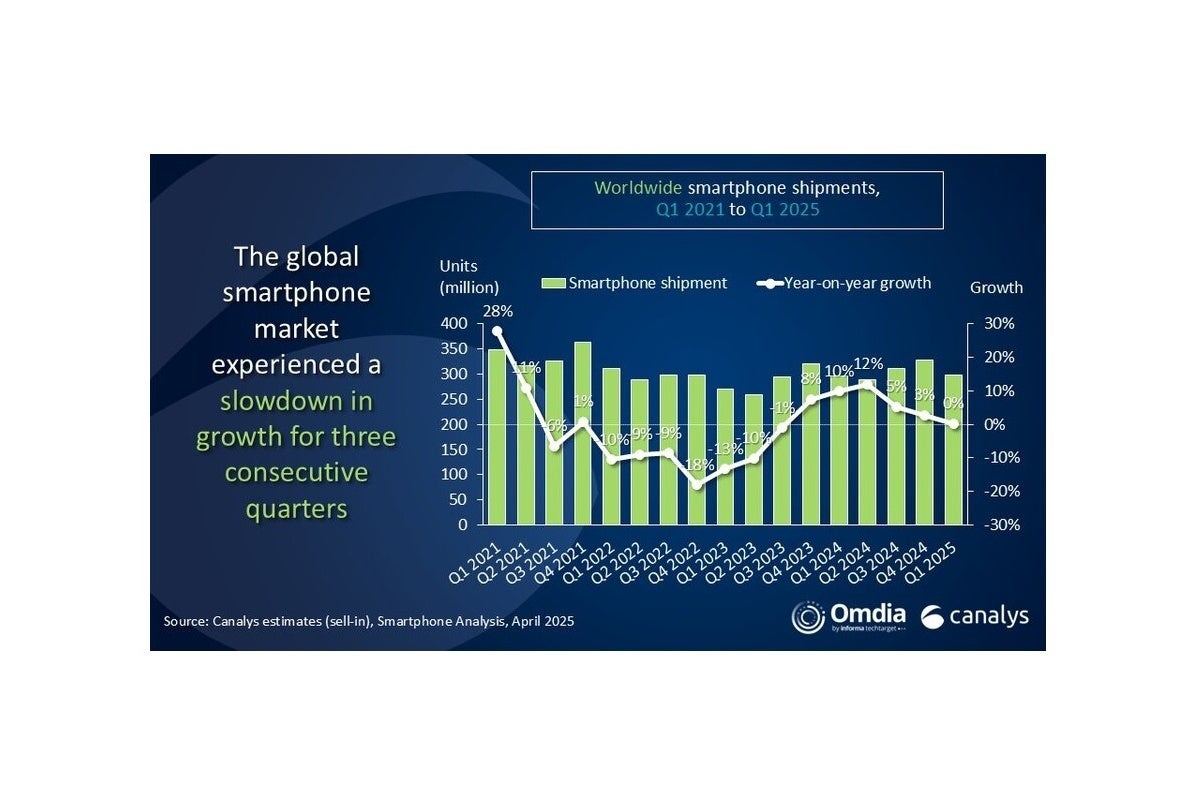

In total, 296.9 million smartphones were apparently shipped worldwide in the opening quarter of the year, representing a teeny-tiny increase of 0.2 percent (or just 700,000 units) from the January-March period of 2024. Looking ahead to the industry’s short-term future, “major” brands are expecting a “market rebound” in Q2 and the rest of the year, but analysts are cautious about making such predictions.

No one can say for sure if the smartphone market will grow or not for the rest of the year.